NOTICE OF 20162021 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

FIRST BUSINESS FINANCIAL SERVICES, INC.

401 Charmany Drive

Madison, WI 53719

March 9, 2021

Dear Fellow Shareholder:

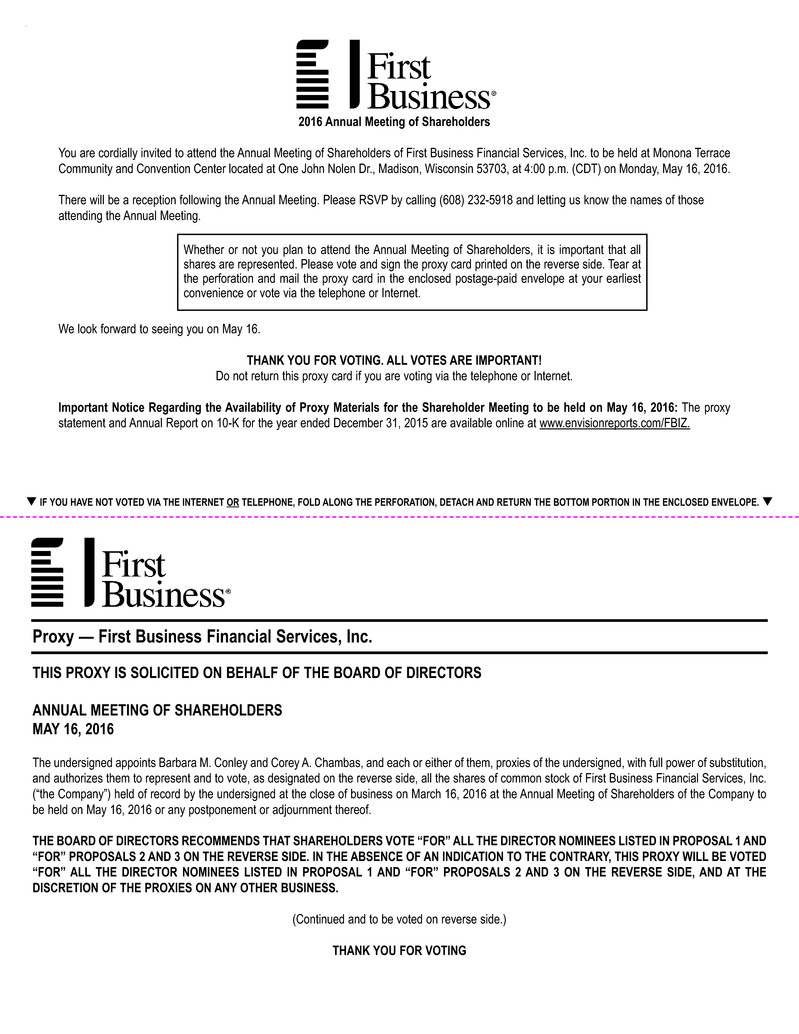

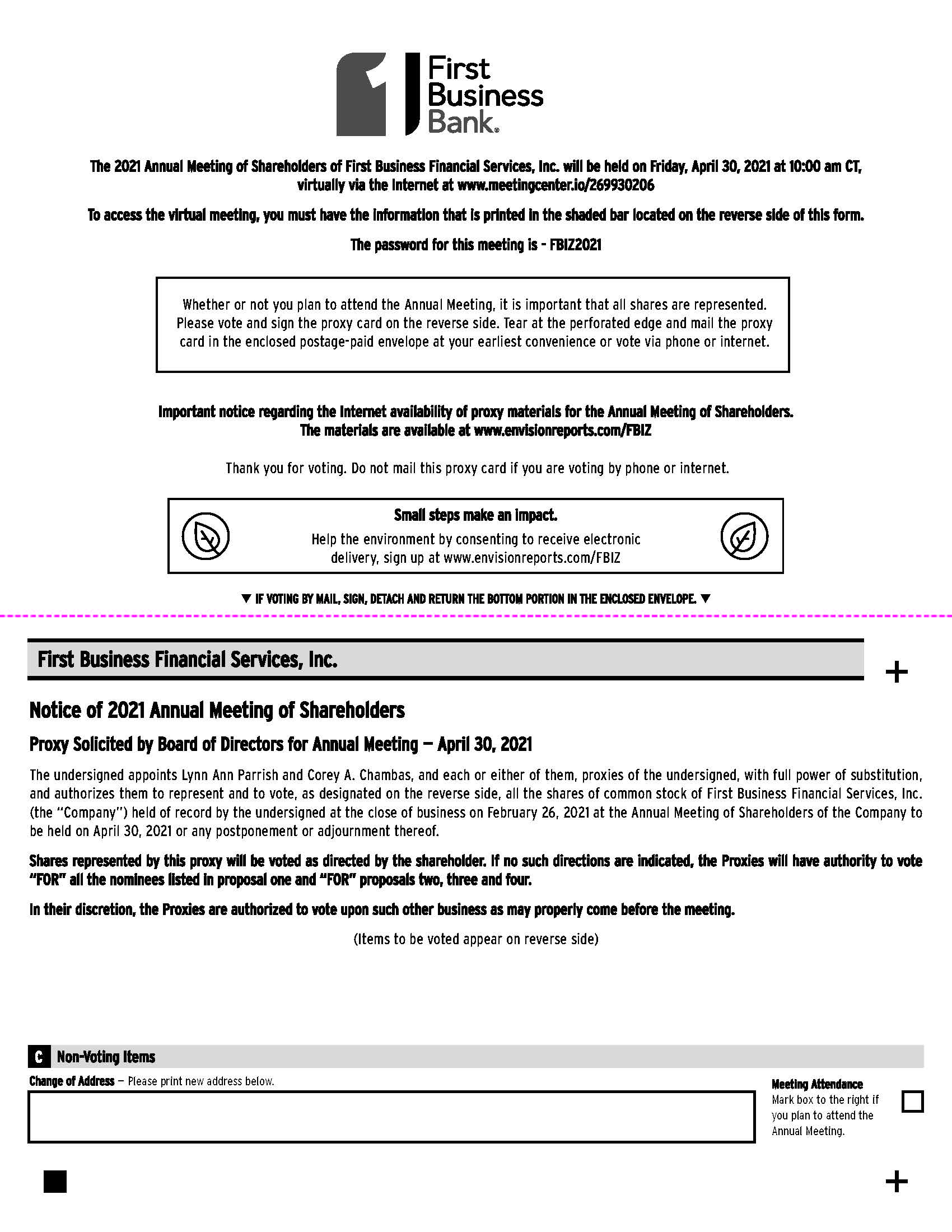

You are cordially invited to attend the 2016 annual meeting2021 Annual Meeting of shareholdersShareholders (“Annual Meeting”) of First Business Financial Services, Inc. (the “Company”), which on Friday, April 30, 2021 at 10:00 a.m. CDT.To provide expanded access, improved communication, and cost savings for our shareholders and the Company, we are holding the Annual Meeting via a virtual meeting format. We believe that hosting a virtual meeting will enable greater shareholder attendance and participation from any geographic location.There is no physical location for the meeting, but you will be held at 4:00 P.M.able to attend and participate in the Annual Meeting online, vote your shares electronically, and submit your questions prior to and during the meeting by visiting www.meetingcenter.io/269930206, local time, on Monday, May 16, 2016 atentering your control number and the Monona Terrace Community and Convention Center located at One John Nolen Drive, Madison, Wisconsin. Atpassword, FBIZ2021.

Although 2020 presented unprecedented challenges related to the annual meeting, we will reviewCOVID-19 pandemic, the Company’s activities during the past yearemployees dedicated themselves to supporting each other and shareholders will be given an opportunityour clients in exceptional ways to address questionsdeliver for our clients, our communities, and our shareholders.We encourage you to the Company’s management.

COVID-19 pandemic.

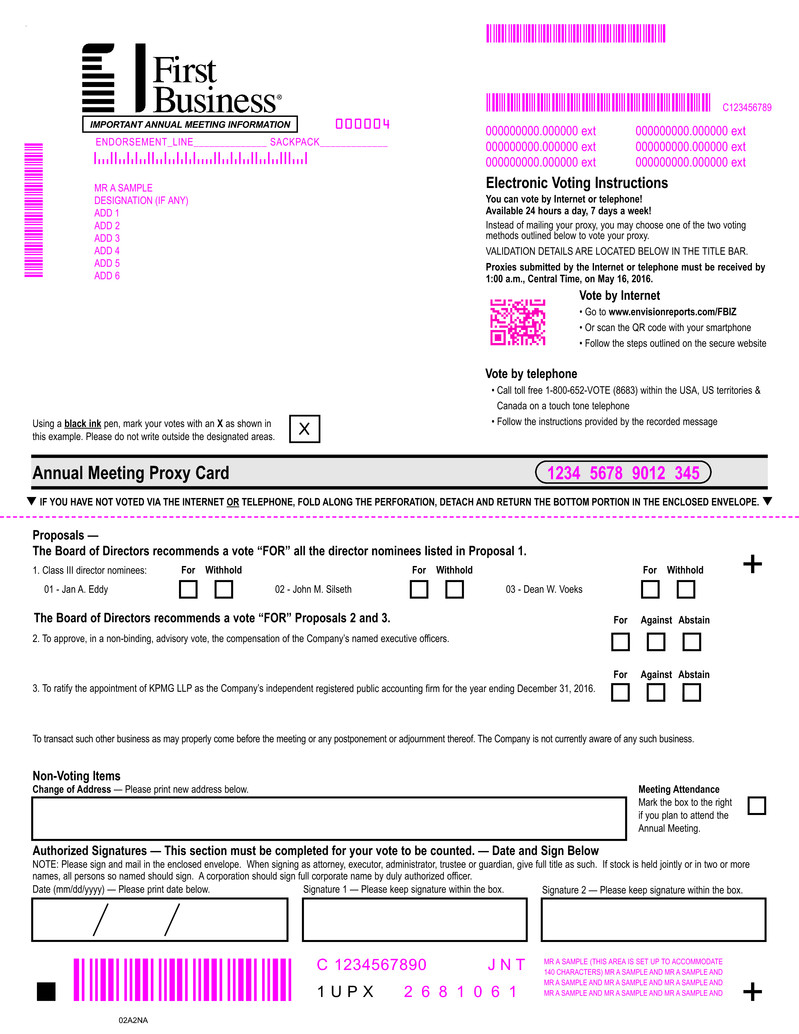

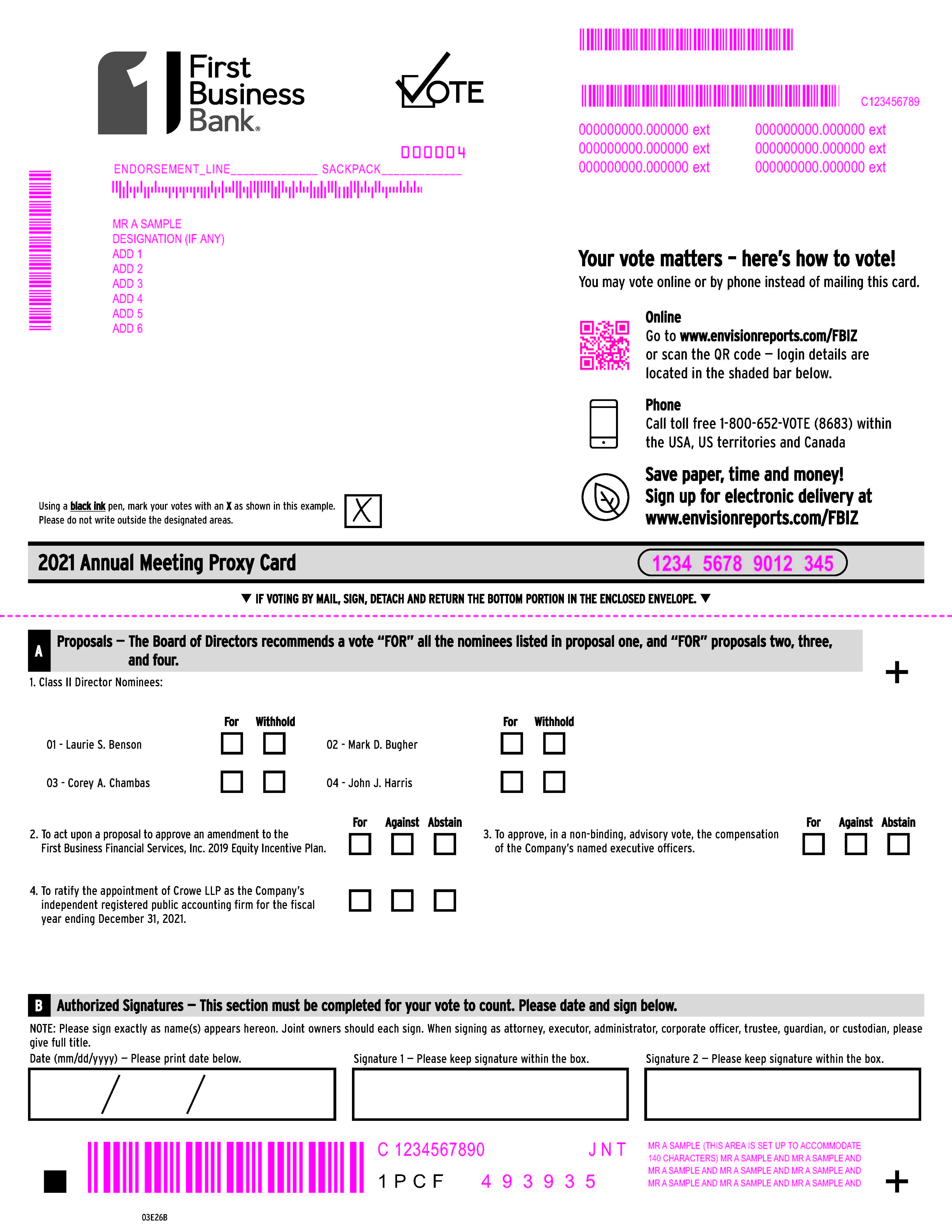

The Board of Directors of the Company recommends that you vote your shares “FOR”“FOR” all the nominees listed in proposalone, and “FOR” proposals two, three, and three.four.

Your continued support is appreciated and we hope you will attend the annual meeting.Annual Meeting. Whether or not you are personally present,attend, it is very important that your shares are represented at the meeting. Accordingly, please vote your shares by following the instructions on the Notice. Notice of Annual Meeting of Shareholders. Your vote is important. Please join us and the Board of Directors in supporting these proposals.

Sincerely,

|  | ||||

| Jerry Kilcoyne | Corey Chambas | ||||

| Board Chair | President and Chief Executive Officer | ||||

FIRST BUSINESS FINANCIAL SERVICES, INC.

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

| Date and Time | Place | |||||||||

| Friday, April 30, 2021 | Virtual Meeting | ||||||||||

| 10:00 a.m. CDT | www.meetingcenter.io/269930206 | ||||||||||

| Password: FBIZ2021 | |||||||||||

NOTICE IS HEREBY GIVENthat the annual meetingAnnual Meeting of shareholders of First Business Financial Services, Inc. (the “Company”Shareholders (“Annual Meeting”) will be held at 10:00 a.m., Central Daylight Saving Time (“CDT”) on Monday, May 16, 2016, at 4:00 P.M., local time, atFriday, April 30, 2021. There is no physical location for this meeting, but shareholders may participate in the Monona Terrace Communityvirtual meeting by logging in using the information included above. Additional instructions on how to attend the Annual Meeting follow this notice. Shareholders as of the record date, can participate online, vote shares electronically, and Convention Center located at One John Nolen Drive, Madison, Wisconsin 53703, forsubmit questions prior to and during the following purposes:meeting.

Matters to be Voted on:

1.To elect threethe four Class III directorsII director nominees named in the proxy statement, each to hold office until the 2019 annual meeting2024 Annual Meeting of shareholdersShareholders and until their successors are duly elected and qualified.

2.To act upon a proposal to approve an amendment to the First Business Financial Services, Inc. 2019 Equity Incentive Plan.

If you were a shareholder at the close of business on March 16, 2016 has been fixed as the record date for the determination of shareholders entitled to notice of, andFebruary 26, 2021, you are eligible to vote at the meeting. In the event there2021 Annual Meeting.

Your vote is an insufficient number of votes for a quorumimportant, no matter how large or to approve any of the proposalssmall your holdings may be:

To assure your representation at the time of the annual meeting, the meeting may be adjourned or postponed in order to permit the further solicitation of proxies.

You may vote your shares by following the instructions included within this proxy statement and on the Notice of Internet Availability of Proxy Materials or in person atyou may vote online during the 2016 annual meeting of shareholders. On or about April 15, 2016, we will also mail a proxy card to all registered shareholders, but not the proxy materials, that will allow voting of shares by completing and returning the proxy card. Annual Meeting.You may revoke your proxy and vote your shares in person at the meetingonline or by using any of the voting options provided in accordance with the instructions provided. Please review the Notice of Internet Availability of Proxy Materials and follow the directions carefully in exercising your vote.

By Order of the Board of Directors

Important Information About Voting and Annual Meeting Participation

Voting Your vote is important, no matter how largeShares

REGISTERED Shareholders:

If you are a registered holder, meaning that you hold your shares directly through our transfer agent, Computershare (not through a bank, broker, or small your holdingsother nominee), you may be. To assure your representation at the meeting, please vote by submitting your proxy:

Online Going to www.envisionreports.com/FBIZ and following the online instructions. You will need information from your Notice of Internet Availability or proxy card, as applicable, to submit your proxy | |||||

By Phone Calling the phone number located on the top of your proxy card and following the voice prompts. You will need information from your proxy card to submit your proxy | |||||

Mail(if you received your proxy materials by mail) Marking your vote on your proxy card, signing your name exactly as it appears on your proxy card, dating your proxy card, and returning it in the envelope provided | |||||

BENEFICIAL Shareholders:

If you are a Beneficial shareholder, meaning that you hold shares through an intermediary, such as a bank or broker (commonly referred to as holding shares in “street name”), you should have received these proxy materials from your bank or broker by mail or email with information on how to submit your voting instructions.

ANNUAL MEETING REGISTRATION AND PARTICIPATION

Registering to Attend the Annual Meeting

REGISTERED Shareholders (if your shares are held directly through our transfer agent, Computershare): As a registered shareholder, you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the Notice or Proxy Card that you received.

BENEFICIAL Shareholders(ADVANCE MEETING REGISTRATION REQUIREDno later than 5:00 p.m. CDT on Monday, April 26, 2021):If you hold shares through an intermediary, such as a bank or broker, and want to attend the Annual Meeting online with the ability to ask a question and/or vote, you have two options to submit proof of Internet Availabilityyour proxy power (“Legal Proxy”) from your broker or bank reflecting your First Business Financial Services, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. CDT on Monday, April 26, 2021. Requests for registration should be directed to Computershare at the following:

By email: Forward the email from your broker, or attach an image of your Legal Proxy, to: legalproxy@computershare.com | |||||

By mail (must be received no later than Monday, April 26, 2021): Computershare First Business Financial Services, Inc. Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 | |||||

You will receive a confirmation of Proxy Materials.your registration by email after Computershare receives your registration materials.

Attending the Annual Meeting

To participate in the Annual Meeting, you will need to review the information included on your Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders, on your proxy card or on the instructions that accompanied your proxy materials. Beneficial shareholders that have pre-registered in advance and Registered shareholders will be able to Be Heldattend the Annual Meeting online by visiting www.meetingcenter.io/269930206, vote their shares, and submit questions during the Annual Meeting.

The online meeting will begin promptly at 10:00 a.m. CDT on May 16, 2016: CopiesFriday, April 30, 2021.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most up-to-date version of this Notice, Proxy Statementapplicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. If you encounter technical difficulties with the virtual meeting platform on the day of the Annual Meeting, a link on the meeting page will provide further assistance should you need it or you may call 1-888-724-2416.

Submitting Questions Prior to and During the Annual Meeting

Beginning on March 9, 2021, Beneficial shareholders that have pre-registered in advance of the Annual Meeting and Registered shareholders may submit questions by going to the virtual meeting site at www.meetingcenter.io/269930206, entering your control number and the Company’s Annual Reportpassword, FBIZ2021. Once logged in, click on Form 10-K for the fiscal year ended December 31, 2015messages icon at the top of the screen to type in your question, then click the arrow icon on the right to submit.

Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. The meeting is not to be used as a forum to present personal matters, or general economic, political or other views that are not directly related to the business of First Business Financial Services, Inc. and the matters properly before the meeting, and therefore questions on such matters will not be answered. Any questions pertinent to the meeting matters that cannot be answered during the meeting due to time constraints will be answered and posted online at ir.firstbusiness.bank/presentations. The questions and answers will be available at www.envisionreports.com/FBIZ.as soon as practical after the meeting and will remain available until one week after posting.

Assessment of Compensation Risk | |||||

COMPENSATION COMMITTEE REPORT | |||||

Compensation Committee Interlocks and Insider Participation | |||||

EXECUTIVE COMPENSATION | |||||

Summary Compensation Table | |||||

Grant of Plan-Based Awards | |||||

Outstanding Equity Awards at | |||||

Corey A. Chambas | |||||

Other Named Executive Officers | |||||

Tax Deductibility of Compensation | |||||

RELATED PARTY TRANSACTIONS | |||||

REPORT OF THE AUDIT COMMITTEE | |||||

MISCELLANEOUS | |||||

Independent Registered Public Accounting Firm | |||||

Audit Committee Pre-Approval Policy | |||||

OTHER MATTERS | |||||

FIRST BUSINESS FINANCIAL SERVICES, INC.

401 Charmany Drive

Madison, Wisconsin 53719

PROXY STATEMENT

For

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 16, 2016April 30, 2021

SOLICITATION OF PROXY, REVOCABILITY AND VOTING OF PROXIES

This proxy statement is being furnished to shareholders by the Board of Directors (the “Board”) of First Business Financial Services, Inc. (the “Company”) beginning on or about April 1, 2016March 9, 2021 in connection with a solicitation of proxies by the Board for use at the annual meetingAnnual Meeting of shareholdersShareholders to be held on Monday, May 16, 2016,Friday, April 30, 2021, at 4:10:00 P.M.A.M., local time, at the Monona Terrace Community and Convention Center at One John Nolen Drive, Madison, Wisconsin 53703,CDT , via a virtual online meeting format, and all adjournments or postponements thereof (the “Annual Meeting”) for the purposes set forth in the Notice of Annual Meeting of Shareholders. InstructionsIn accordance with rules and regulations of the Securities and Exchange Commission (the “SEC”), we furnish proxy materials, which include this proxy statement, the Notice of Annual Meeting and our Annual Report on Form 10-K for voting your shares are includedfiscal year ended December 31, 2020, to our shareholders by making such materials available on the Internet unless otherwise instructed by the shareholder. The Notice of Internet Availability of Proxy Materials (the “Notice”).

Voting your shares pursuant toin advance of the instructions contained on the NoticeAnnual Meeting will not affect a shareholder’syour right to attend and cast your vote online during the Annual Meeting and to vote in person.Meeting. However, when you vote pursuant to the proxy card or one of the methods set forth in the Notice, you appoint the proxy holder as your representative at the Annual Meeting. The proxy holder will vote your shares as you instruct, thereby ensuring that your shares will be voted whether or not you attend the Annual Meeting. PresenceAttendance at the Annual Meeting of a shareholder who has appointed a proxy does not in itself revoke a proxy. Any shareholder appointing a proxy may revoke that appointment at any time before it is exercised by: (i) giving notice thereof to the Company in writing or atduring the Annual Meeting; (ii) signing another proxy, if you voted by mailing in a proxy card, with a later date and returning it to the Company; (iii) timely submitting another proxy via the telephone or Internet, if that is the method you used to submit your original proxy; or (iv) voting in person atonline during the Annual Meeting. Even if you plan to attend the Annual Meeting online, we ask that you instruct the proxies how to vote your shares in advance of the Annual Meeting in case your plans change.

If you appointed the proxies to vote your shares and an issue comes up for a vote at the Annual Meeting that is not identified in the proxy materials, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

If you sign and return a proxy card or vote over the Internet or by telephone without giving specific voting instructions, the shares represented by your proxy will be voted “FOR” the threefour persons nominated for election as

1

directors referred to in this proxy statement, "FOR" the approval of the proposed amendment to the 2019 Equity Incentive Plan, “FOR” the approval of the non-binding, advisory proposal on the compensation of named executive officers, which is referred to as a “say-on-pay” proposal, “FOR” the ratification of the appointment of KPMGCrowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016,2021, and on such other business matters which may properly come before the Annual Meeting in accordance with the best judgment of the persons named as proxies. Other than the above proposals, the Board has no knowledge of any matters to be presented for action by the shareholders at the Annual Meeting.

Only holders of record of the Company’s common stock,Common Stock, par value $0.01 per share (the “Common Stock”), at the close of business on March 16, 2016February 26, 2021 are entitled to vote at the Annual Meeting. On that date, the Company had outstanding and entitled to vote 8,700,1728,640,143 shares of Common Stock, each of which is entitled to one vote.

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

The Company is committed to good corporate governance, which promotes the long-term interests of the shareholders and provides a strong foundation for business operations. All Company directors serve as directors of both the Company and its wholly-owned subsidiary, First Business Bank (“FBB” or the "Bank"), which eliminates redundancies, simplifies and streamlines governance processes and enhances the Board’s oversight of the Company’s strategic initiatives. The Corporate Governance and Nominating Committee regularly reviews governance best practices and considers and evaluates these practices in the context of maximizing long-term shareholder value when making recommendations to the Board and shareholders.

Director Selection, Qualifications and Nominations

In making recommendations to the Company’s Board with respect to nominees to serve as directors, the Corporate Governance and Nominating Committee will examine each director nominee on a case-by-case basis, regardless of who recommended the nominee, and take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen and industry knowledge. In evaluating director nominees, the Board, with the assistance of the Corporate Governance and Nominating Committee, considers diversity of viewpoint, backgrounds, technical skills, industry knowledge and experience and local or community ties as well as diversity of personal characteristics such as race, gender, age, ethnicity and geographic representation as outlined in the Company's Director Diversity, Equity, and Inclusion Policy to ensure a balanced, diverse Board, with each director contributing talents, skills and experiences needed for the Board as a whole. The Board and the Committee intend to assess the effectiveness of the Director Diversity, Equity and Inclusion Policy, which was adopted in 2021, on a periodic basis.

In 2021, the Board adopted a Director Resignation Policy ("DR Policy"). The DR Policy requires that any director receiving a greater number of votes "withheld" or "against" their election than votes "for" will tender their resignation to the Board Chair. The Board, in its discretion, may accept or reject the tendered resignation in accordance with the DR Policy, which is as outlined in the Corporate Governance Guidelines on the Company’s website located at ir.firstbusiness.bank/govdocs.

2

The Board also believes the following minimum qualifications must be met by a director nominee to be recommended by the Corporate Governance and Nominating Committee:

•Strong personal and professional ethics, integrity and values.

•The ability to exercise sound business judgment.

•Accomplished in their respective field as an active or former executive officer of a public or private organization, with broad experience at the administrative and/or policy-making level in business, government, education, technology or public interest.

•Relevant expertise and experience and the ability to offer advice and guidance based on that expertise and experience.

•Independence from any particular constituency, the ability to represent all shareholders of the Company and a commitment to enhancing long-term shareholder value.

•Sufficient time available to devote to activities of the Board and to enhance their knowledge of the Company’s business.

Using a defined director succession planning process as a component of Board succession planning, the Corporate Governance and Nominating Committee works with the Board to evaluate:

•Board composition and assess whether directors should be added in view of director departures,

•the number of directors needed to fulfill the Board’s responsibilities under the Company’s Corporate Governance Guidelines and committee charters, and

•the skills and capabilities that are relevant to the Board’s work and the Company’s strategy.

In making recommendations to the Board, the Corporate Governance and Nominating Committee considers the mix of different tenures of directors, taking into account the benefits of directors with longer tenures including greater Board stability, continuity of organizational knowledge and the critical importance of expertise and understanding of the commercial banking industry as well as the benefits of directors with shorter tenures who help to foster new ideas and examination of the status quo. As part of its on-going responsibility to identify prospective directors to provide an appropriate balance of knowledge, experience, background and capability on the Board, the Corporate Governance and Nominating Committee regularly evaluates director candidates to recommend for the Board’s consideration and possible appointment to the Board.

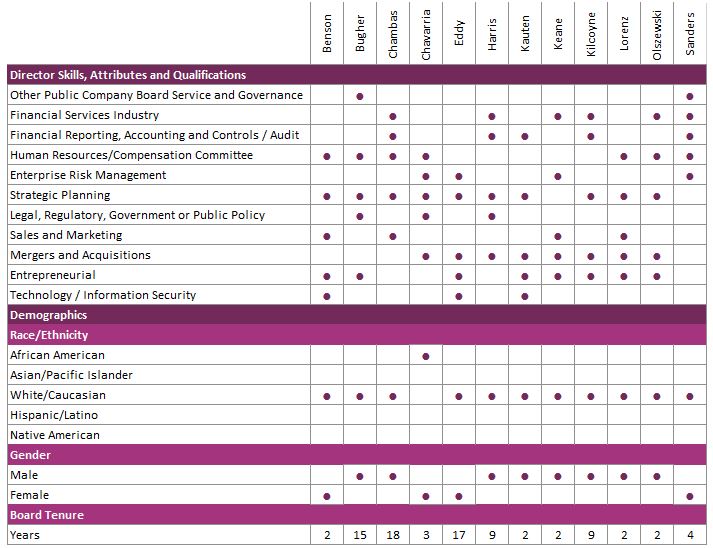

The following table summarizes key qualifications, skills and attributes relevant to the decision to nominate candidates to serve on the Board and possessed by current directors. A mark indicates this particular qualification, skill or attribute was identified as one of the director’s top five strongest qualifications, skills or attributes, but the absence of a mark does not mean the director does not possess that qualification, skill or attribute. Detailed director biographies are included on pages 6 through 12 of this proxy statement.

3

The Corporate Governance and Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Corporate Governance and Nominating Committee should be sent to the Corporate Secretary of the Company in writing together with appropriate biographical information concerning each proposed nominee. The Company’s Amended and Restated By-Laws also set forth certain requirements for shareholders wishing to nominate director candidates directly for consideration by the shareholders. With respect to an election of directors to be held at an annual meeting, a shareholder must, among other things, give notice of an intent to make such a nomination to the Corporate Secretary of the Company not less than 60 days or more than 90 days prior to the date of the previous year’s annual meeting (subject to certain exceptions if the annual meeting is advanced or delayed a certain number of days). Under the Amended and Restated By-Laws, if the Company does not receive notice of an intent to make such a nomination on or after January 30, 2022 and on or prior to March 1, 2022, then the notice will be considered untimely and the Company will not be required to present such nomination at the 2022 annual meeting.

4

Director Refreshment: Evaluation Process, Development and Education

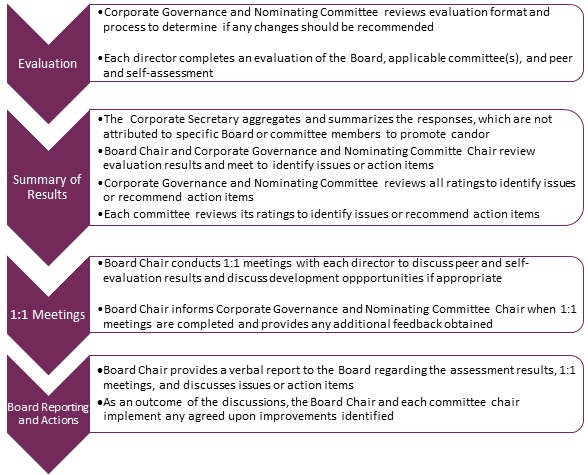

The Board recognizes that a constructive evaluation process is an essential component of director refreshment and annually conducts a robust peer and self-evaluation in conjunction with its annual Board and committee evaluation process. The Corporate Governance and Nominating Committee oversees the evaluation process and reviews the format of the evaluation to ensure that actionable feedback is solicited related to the operation of the Board, its committees and director performance. In addition to evaluating the Board and committees, the peer and self-evaluation process serves as a mechanism to measure clear performance standards, both objective and subjective, and the Board Chair meets annually with each director to review their evaluation results. The chart below outlines the evaluation process.

The Board is committed to continuing director education and development and solicits director feedback on education topics. This feedback was utilized to develop educational opportunities in 2020 including internally developed presentations as well as programs presented by third parties on topics such as: strategic planning; executive compensation best practices and trends; human capital management; diversity, equity, and inclusion ("DEI"); cybersecurity; governance best practices, and emerging issues in the financial services sector. The Company provides financial support for director education and the Corporate Governance and Nominating Committee reviews the Director Education Report at each quarterly committee meeting. All directors are in compliance with the Board’s director education guidelines.

5

ITEM 1 – ELECTION OF DIRECTORS

The Company’s Amended and Restated BylawsBy-Laws provide that the directors shall be divided into three classes, with staggered terms of three years each. At the Annual Meeting, the shareholders will elect threefour directors to hold office until the 2019 annual meeting2024 Annual Meeting of shareholdersShareholders and until their successors are duly elected and qualified. Unless shareholders otherwise specify, the shares represented by the proxies received will be voted in favor of the election as directors of the threefour persons named as nominees by the Board herein. The Board has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected, except for Mr. Voeks who is expected to retire in 2018 in accordance with the Board’s Director Retirement Policy. However, inelected. In the event that any nominee should be unable or unwilling to serve, the shares represented by proxies received will be voted for another nominee selected by the Board. Each director will be elected by a plurality of the votes cast at the Annual Meeting (assuming a quorum is present). Consequently, any shares not voted at the Annual Meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. As previously discussed, any nominee for election as a director who receives a greater number of votes "withheld" or "against" their election than votes "for" their election will tender their resignation to the Board in accordance with the Company's DR Policy as outlined in the Corporate Governance Guidelines on the Company’s website located at ir.firstbusiness.bank/govdocs. Votes will be tabulated by an inspector of elections appointed by the Board.

The following sets forth certain information, as of January 11, 2016, about the Board’s nominees for election at the Annual Meeting and each director of the Company whose term will continue after the Annual Meeting.

Nominees for Election at the Annual Meeting

Terms expiring at the 20192024 Annual Meeting

| Laurie S. Benson, age 67, has served as a director of the Company since December 2018, is the Chair of the Corporate Governance and Nominating Committee, and a member of the Compensation Committee. She has served as director on the FBB Board since July 2009 and as a member of the FBB Northeast Wisconsin Advisory Board since August 2012. Ms. Benson has served as the Executive Director of Nurses on Boards Coalition since 2016. Ms. Benson is the CEO of LSB Unlimited, which provides consulting services to businesses on complex issues and opportunities. Ms. Benson co-founded and served as CEO of Inacom Information Services from its inception in 1984 | ||||

| until its sale to CORE BTS in 2009. She currently serves on the boards of several privately held companies. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Ms. StephensBenson is qualified to serve on the Board, as well as the Compensation Committee, include executive level experience in human resources with a public company, over 20 years of general human resources experience including executive compensation and benefits oversight and a strong background in leadership development and succession planning.

6

| Mark D. Bugher, age 72, has served as a director of the Company since July 2005, is Compensation Committee Chair and a member of the Corporate Governance and Nominating Committee. Mr. Bugher joined the FBB Board in November 2018. Mr. Bugher served as the Director of University Research Park in Madison, Wisconsin from 1999 until his retirement in November 2013. Prior to this role, Mr. Bugher served as Secretary of the State of Wisconsin Department of Revenue and Secretary of the State of Wisconsin Department of Administration.Mr. Bugher serves on the board of directors of MGE Energy, Inc., a publicly traded utility company, and its affiliate, Madison Gas and Electric Company and has been elected as lead director and chair of | ||||

| the corporate governance committee of MGE Energy, Inc. effective May 18, 2021. He currently serves on the audit committee and the executive committee and previously served as a member and as chair of the compensation committee of MGE Energy, Inc. Mr. Bugher additionally serves on the board of directors and as Chair of the Marshfield Clinic Health System and has served in leadership positions as chair or board member for many organizations promoting economic development in Wisconsin. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Bugher is qualified to serve on the Board, as well as the Compensation Committee and Corporate Governance and Nominating Committee, include the items referenced on the Director Skills, Attributes and Compensation Committee, includeQualifications Matrix as well as his executive levelexecutive-level experience in strategy development and implementation, governance experience through service on boards including another public company board and other board committees, economic development expertise, and a strong background in the commercial real estate, government and health care sectors.

| Corey A. Chambas, age 58, has served as a director of the Company since July 2002, as Chief Executive Officer (“CEO”) of the Company since December 2006 and as President of the Company since February 2005. He served as Chief Operating Officer of the Company from February 2005 to September 2006 and as Executive Vice President of the Company from July 2002 to February 2005. Mr. Chambas joined the FBB Board in November 2018. He served as CEO of FBB from July 1999 to September 2006 and as President of FBB from July 1999 to February 2005. He currently serves as a director of First Madison Investment Corp., a wholly-owned subsidiary of FBB. Mr. Chambas also | ||||

| serves as chair of the board of directors and as a member of the management development & compensation committee of M3 Insurance Solutions, Inc., a privately held insurance agency, and has served on the boards of other privately held companies and non-profit organizations. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Chambas is qualified to serve on the Board include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as the depth and breadth of his experience as Chief Executive OfficerCEO of the Company and his over 30 years of financial services industry experience with specific focus in the commercial banking sector, his CEO-level experience in core management disciplines including strategy development and implementation, human resources, financial management and sales and marketing and his governance experience through service on the boards of other privately held companies and non-profit organizations.

7

| John J. Harris, age 68, has served as a director of the Company since January 2012 and is a member of the Audit Committee and Operational Risk Committee. Mr. Harris joined the FBB Board in November 2018. Mr. Harris served as a professional in the investment banking industry for most of his career, most recently as Managing Director of the Investment Banking Financial Institutions Group of Stifel Nicolaus Weisel. Mr. Harris retired from this position in 2010. Prior to this role, Mr. Harris was Managing Director of the Investment Banking Financial Institutions Group of Piper Jaffray & Co. from 2005 to 2007 and a Principal in the Investment Banking Financial Institutions Group of William Blair & Co., LLC from 2000 to 2005. | ||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Harris is qualified to serve on the Board, as well as on the Audit Committee and Operational Risk Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as over 25 years of experience providing financial advisory services to senior management, boards and special committees of publicly traded and privately held companies; hiscompanies, extensive experience in the financial services sector and with mergers and acquisitions;acquisitions, and his significant work advising clients on capital formation and execution of public and private capital raises.

THE BOARD RECOMMENDS EACH OF THE FOREGOING NOMINEES FOR ELECTION AS DIRECTOR AND URGES EACH SHAREHOLDER TO VOTE “FOR” EACH OF THE NOMINEES.

8

Directors Continuing in Office

Terms expiring at the 2022 Annual Meeting

| Jan A. Eddy, age 71, has served as a director of the Company since October 2003 and serves on the Corporate Governance and Nominating Committee and the Compensation Committee. Ms. Eddy joined the FBB Board in November 2018. She previously served as a director of FBB from April 1990 to May 2010 and served as FBB Board Chair from January 2004 to May 2010. Ms. Eddy founded Wingra Technologies, a designer and distributor of software, and served as President and Chief Executive Officer of Wingra Technologies from October 1991 to January 2005, when Quest Software purchased Wingra Technologies. Ms. Eddy held the position of Business Development Executive | ||||

| at Quest Software from January 2005 until her retirement in October 2005. Ms. Eddy serves or has served on the boards of other privately held companies and non-profit organizations. As previously disclosed in the Company's Form 8-K filed with the SEC on February 1, 2021, Ms. Eddy will retire from the Company's Board following the completion of her term expiring at the 2022 Annual Meeting. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Ms. Eddy is qualified to serve on the Board, as well as on the Corporate Governance and Nominating Committee and the Compensation Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as her financial services industry expertise as an FBB director, CEO-level experience as founder and chief executive officer of her own company in strategy development and implementation, mergers and acquisitions and enterprise risk management, her significant governance experience from service on other boards and her strong background in information technology.

| Timothy J. Keane, age 74, has served as a director of the Company since December 2018 and serves on the Operational Risk Committee. He has served as a director of FBB since August 2017. He previously served on the FBB-Milwaukee Board from January 2004 until the Bank charter consolidation in June 2017 at which time he became a member of the FBB Southeast Wisconsin Advisory Board. Mr. Keane has served on the FBB Kansas City Metro Advisory Board since August 2017. Mr. Keane is the Managing Investor and Director of Golden Angels Investors, LLC, President of Keane Consultants, is a limited partner in several venture and private equity funds, and provides data | ||||

| analytics strategy consulting services to a small group of companies. He was the founder and CEO of Retail Target Marketing Systems (RTMS), now a unit of Fidelity Information Services. Mr. Keane serves on the boards of other privately held companies. As previously disclosed in the Company's Form 8-K filed with the SEC on February 1, 2021, Mr. Keane will retire from the Company's Board in accordance with the Director Retirement Policy following the completion of his term expiring at the 2022 Annual Meeting. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Keane is qualified to serve on the Board, as well as the Operational Risk Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as his financial services industry expertise as an

9

FBB director, his CEO-level experience as founder of multiple companies, 15 years of leading entrepreneurship programs, and his experience in enterprise risk management, data analytics, and mergers and acquisitions.

| W. Kent Lorenz, age 58, has served as a director of the Company since June 2018 and serves on the Audit Committee and Operational Risk Committee. He has served as a director of FBB since August 2017. He previously served on the FBB-Milwaukee Board from January 2010 until the Bank charter consolidation in June 2017 at which time he became a member of the FBB Southeast Wisconsin Advisory Board. Mr. Lorenz is the retired Chairman and CEO of Acieta LLC, a provider of advanced industrial robotic automation systems to North American manufacturers and their global affiliates. He is the Owner and Managing Director of Lakeside Consulting, LLC, a manufacturing and | ||||

| industrial automation consulting firm. Mr. Lorenz served on the Wisconsin Technical College System Board of Directors from June 2014 until March 2020. He also serves on the boards of other private and non-profit organizations. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Lorenz is qualified to serve on the Board, as well as the Audit Committee and Operational Risk Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as his financial services industry expertise as an FBB director, his CEO-level experience in core management disciplines, strategy development and implementation, human resources, financial management, mergers and acquisitions, and his governance experience through service on other boards.

| Carol P. Sanders, age 54, has served as a director of the Company since September 2016 and is the Audit Committee Chair. Ms. Sanders joined the FBB Board in November 2018. Ms. Sanders has been the President of Carol P. Sanders Consulting LLC, a consulting firm providing executive-level consulting services to the insurance and technology industries, since July 2015. Ms. Sanders has over 25 years of experience in the insurance industry, including serving as the Executive Vice President, Chief Financial Officer and Treasurer of Sentry Insurance from July 2013 to June 2015 and as Executive Vice President and Chief Operating Officer of Jewelers Mutual Insurance Company from November 2012 to June | ||||

| 2013 where she previously served in other executive capacities from September 2004 to November 2012. Ms. Sanders has served on the board of directors of Alliant Energy Corporation (“Alliant”), a publicly traded Wisconsin-based public utility holding company, and its two utility subsidiaries since December 2005. She currently serves as Alliant’s lead independent director, chair of Alliant’s nominating and governance committee and previously served as a member and chair of Alliant’s audit committee and compensation and personnel committee. Ms. Sanders has served on the board of directors of RenaissanceRe Holdings Ltd. (“RenaissanceRe”), a publicly traded global provider of reinsurance and insurance, since 2016 and is a member of that company’s audit committee. Ms. Sanders also serves on the board of a privately held company. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Ms. Sanders is qualified to serve on the Board, as well as the Audit Committee, include the items referenced on the

10

Director Skills, Attributes and Qualifications Matrix as well as over 25 years of experience as an executive in the insurance industry, her board and committee service with other public companies and her executive-level background in finance, operations, strategic planning, enterprise risk management and human resources.

Terms expiring at the 2023 Annual Meeting

| Carla C. Chavarria, age 55, has served as a director of the Company since June 2017 and is a member of the Corporate Governance and Nominating Committee and Compensation Committee. Ms. Chavarria joined the FBB Board in November 2018. Ms. Chavarria is Senior Vice President of Human Resources and Chief Human Resources Officer and a member of the executive committee for AMC Entertainment Inc., a publicly traded company. In this role she is responsible for the strategic development and implementation of total rewards, associate engagement, diversity, equity and inclusion, community relations, employment practices, human resource systems, talent acquisition and training and development. Ms. Chavarria has served on the boards of several community and non-profit organizations. | ||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Ms. Chavarria is qualified to serve on the Board, as well as the Corporate Governance and Nominating Committee and Compensation Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as her background as an executive in human resources, recruitment, and strategic development of human resources systems and services for over 20 years as well as her executive-level experience in enterprise risk management and strategic planning.

| Ralph R. Kauten, age 69, has served as a director of the Company since December 2018 and is a member of the Audit Committee and Operational Risk Committee. He has served on the FBB Board since July 2004 and served as FBB Board Chair from June 2018 until November 2018. Mr. Kauten is the co-owner of Mirus Bio and owner of Air-Lec Industries, both private companies. Mr. Kauten served as an executive for a number of Wisconsin biotechnology companies, including Promega Corporation, PanVera Corporation, Quintessence Biosciences, Inc. and Lucigen Corporation. His prior positions include being a Faculty Member at the University of Wisconsin-Whitewater, Plant | ||||

| Controller of the Ortega taco plant for Heublein, Inc., and Senior Auditor for Grant Thornton, CPAs. Mr. Kauten is a member of the board of SSM Healthcare of Wisconsin, Inc. and two of its subsidiaries and serves or has served on the boards of other privately held companies and non-profit organizations. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Kauten is qualified to serve on the Board, as well as the Audit Committee and Operational Risk Committee, include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as his financial services industry expertise as an FBB director, being a co-founder and serving as the CEO and chairman of the board for numerous companies in the biotechnology industry, his role in shaping the purpose, vision and strategy of those companies, and his experience in mergers and acquisitions.

11

| Gerald L. (Jerry) Kilcoyne, age 61, has served as a director of the Company since November 2011 and Board Chair since October 2018. Mr. Kilcoyne joined the FBB Board and was elected FBB Board Chair in November 2018. He previously served as a director of FBB from August 2005 through July 2018 and served as FBB Board Chair from May 2010 until June 2018. He served as a director of First Business Equipment Finance, LLC, now known as First Business Specialty Finance, LLC, a wholly-owned subsidiary of FBB, from January 2006 until August 2017 and as a director of Alterra Bank from May 2016 until June 2017 at which time Alterra Bank was consolidated into FBB. He served as a director of First Business Capital Corp., now known as First Business Specialty | ||||

| Finance, LLC, from January 2006 to December 2013. Mr. Kilcoyne has been Managing Partner of Pinnacle Enterprises, LLC, a private investment holding company since February 1997. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Kilcoyne is qualified to serve on the Board include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as his financial services industry expertise as an FBB director, CEO-level experience in strategic planning and financial management, and over 25 years involvement in mergers and acquisitions.

| Daniel P. Olszewski, age 55, has served as a director of the Company since December 2018 and is Chair of the Operational Risk Committee. He has served as a director of FBB since August 2010 and he served as a director of First Business Capital Corp., now known as First Business Specialty Finance, LLC, a wholly-owned subsidiary of FBB, from January 2011 to November 2018. Mr. Olszewski is the Director of the Weinert Center for Entrepreneurship, a campus-wide Entrepreneurship Program, at the UW-Madison School of Business. He previously served as the COO, CEO and chair of the board of PNA Holdings, LLC/Parts Now!, and was CEO of Katun Corporation. He began his career with | ||||

| strategic management consulting firm, McKinsey & Company. Mr. Olszewski currently serves on the board of the National Guardian Life Insurance Company, a private company, and has served on the boards of other privately held companies and non-profit organizations. | |||||

The particular and specific experience, qualifications, attributes or skills that led the Board to conclude Mr. Olszewski is qualified to serve on the Board and the Operational Risk Committee include the items referenced on the Director Skills, Attributes and Qualifications Matrix as well as his financial services industry expertise as an FBB director, background as an executive with responsibility for strategic development in international agribusiness and biotechnology industries as well as his CEO-level experience in acquisition and strategic planning and growth.

12

Director Disclosures

None of the above-named directors or director nominees held a directorship at any public company or any company registered as an investment company under the Investment Company Act during the past five years, except for (i) Mr. Bugher, who serves on the board of directors, as lead independent director, and chair of the governance committee and as a member of the audit and executive committees of MGE Energy, Inc., (ii) Ms. Sanders, who serves on the board of directors, as lead independent director, and chair of the nominating and governance committee of Alliant, and is on the board of directors and a member of the audit committee of MGE Energy, Inc., a public company,

RenaissanceRe, and (iii) Mr. Chambas, who, servesuntil February 26, 2018, served on the board of directors of Three Lakes Securities, LLC, which iswas a registered investment advisor. None of the directors, executive officers or nominees is related to one another and there are no arrangements or understandings between any of the directors, executive officers or any other person pursuant to which any of ourthe Company’s directors or executive officers have been selected for their respective positions. None of the above-named directors or director nominees was a party to any SEC enforcement actions or any legal proceedings that are material to an evaluation of their ability or integrity in the past ten years.

Independent Directors and Meeting Attendance

Of the ninetwelve directors currently serving on the Board, the Board has determined that Mark D. Bugher, Jan A. Eddy, John J. Harris, Gerald L. Kilcoyne, John M. Silseth, Jerome J. Smith, Barbara H. Stephensall except for Mr. Chambas, the Company’s President and Dean W. VoeksChief Executive Officer, are “independent directors” for purposes of applicable NASDAQNasdaq rules.

Directors are expected to attend the Company’s annual meeting of shareholders each year. All twelve directors attended the Company’s 20152020 annual meeting.

The Board held seveneight meetings in 2015.2020. Each director attended at least 75% of the aggregate of (1)(i) the total number of meetings of the Board during 20152020 while they were a director and (2)(ii) the total number of meetings held by all committees of the Board on which such director served during 2015.2020 while they were a member of such committees.

Board Leadership Structure

The roles of Board Chair of the Board and Chief Executive OfficerCEO are held separately. Mr. SmithKilcoyne serves as Board Chair and Mr. Chambas serves as Chief Executive Officer.CEO. The Board believes that at this time, separation of these roles is in the best interests of the Company and its shareholders because separation:

•allows for additional talents, perspectives and skills on the Board;

•preserves the distinction between the Chief Executive Officer’sCEO’s leadership of management and the Board Chair’s leadership of the Board;

•promotes a balance of power and an avoidance of conflict of interest;

•provides an effective channel for the Board to express its views on management; and

•allows the Chief Executive OfficerCEO to focus on leading the Company and the Board Chair to focus on leading the Board, monitoring corporate governance and shareholder issues.

13

Committees

The Board conducts its business through meetings of the Board and the following standing Committees:committees: Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee and Operational Risk Committee. Each of these committees has the responsibilities set forth in a formal written charters adoptedcharter approved by the Board. The Board has also adopted guidelines on significant corporate governance matters that, together with the Company’s Code of Conduct and other policies, create the Board’s corporate governance standards. Copies of these charters and the Corporate Governance Guidelines are available free of charge on the Company’s website located at www.firstbusiness.com.ir.firstbusiness.bank/govdocs. The following table reflects the current membership of each standing Board Committee:committee:

Name(1) | Audit | Compensation | Corporate Governance and Nominating | Operational Risk | ||||||||||

| Laurie S. Benson | ● | ● Chair | ||||||||||||

| Mark D. Bugher | ● Chair | ● | ||||||||||||

| Carla C. Chavarria | ● | ● | ||||||||||||

| Jan A. Eddy | ● | ● | ||||||||||||

| John J. Harris | ● | ● | ||||||||||||

| Ralph R. Kauten | ● | ● | ||||||||||||

| Timothy J. Keane | ● | |||||||||||||

| W. Kent Lorenz | ● | ● | ||||||||||||

| Daniel P. Olszewski | ● Chair | |||||||||||||

Carol P. Sanders(2) | ● Chair | |||||||||||||

| Number of Meetings in 2020 | 5 | 5 | 4 | 4 | ||||||||||

| Name | Audit | Compensation | Corporate Governance & Nominating |

| Mark D. Bugher | X | X | |

| Jan A. Eddy | X | Chair | |

| John J. Harris | X | ||

| Gerald L. Kilcoyne | X | X | |

| John M. Silseth | X | X | |

| Jerome J. Smith | X | X | |

| Barbara H. Stephens | Chair | ||

| Dean W. Voeks | Chair | X | |

| Number of Meetings in 2015 | 9 | 4 | 3 |

| (1) | Mr. Chambas and Mr. Kilcoyne are not members of a standing committee. | |||||||||||||

| (2) | Ms. Sanders qualifies as an “audit committee financial expert”. | |||||||||||||

Audit Committee

The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing the Company’s accounting and financial reporting processes and the audits of the financial statements of the Company. The Audit Committee presently consists of Dean W. VoeksCarol P. Sanders (Chair), John J. Harris, Gerald L. KilcoyneRalph R. Kauten, and John M. Silseth,W. Kent Lorenz, each of whom meets the requirements set forth in NASDAQNasdaq Listing Rule 5605(c)(2)(A) and the independence standards set forth in Rule 10A-3(b)(1) promulgated by the SEC under the Securities Exchange Act of 1934, as amended (The(the “Exchange Act”). The Board has thus determined that each of the Audit Committee’s current members is qualified to serve in such capacity. The Board has determined that John M. SilsethCarol P. Sanders qualifies as an “audit committee financial expert,”expert” for purposes of applicable SEC regulations, and has the financial sophistication required by applicable NASDAQNasdaq rules because heshe has the requisite attributes through, among other things, hisher education and experience as the president of a private investment firm, a certified public accountant and an auditor.financial executive in the insurance industry and her service on the audit committee of other public companies.

14

Compensation Committee

The Compensation Committee reviewsCommittee's primary functions are to review and recommendsrecommend to the Board the compensation structure for the Company’s directors and executive officers, including salary rates, participation in incentive compensation and benefit plans, fringe benefits, non-cash perquisites and other forms of compensation, and administers the Company’s equitylong-term incentive plans. Barbara H. Stephens (Chair),plan and employee stock purchase plan. Mark D. Bugher (Chair), Laurie S. Benson, Carla C. Chavarria, and Jan A. Eddy Gerald L. Kilcoyne and Jerome J. Smith are the current members of the Compensation Committee, each of whom is considered to be “independent” and meets the requirements set forth in applicable NASDAQNasdaq rules and the independence standards set forth in applicableRule 10C-1(b)(1) promulgated by the SEC regulations.under the Exchange Act. The

Board has determined that none of the aforementioned directors has a relationship to the Company which is material to his or hertheir ability to be independent from management in connection with the duties of a Compensation Committee member and has further determined that each of the Compensation Committee’s current members is qualified to serve in such capacity.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee’s primary functions are to recommend persons to be selected by the Board as nominees for election as directors; recommend persons to be elected to fill any vacancies on the Board; lead the Board in its annual review of Board performance,performance; Board and committee structure and director independence; develop and recommend to the Board corporate governance principles, policies and procedures and oversee execution of the Company’s enterprise risk managementsuccession planning program and advise the Board on the effectiveness of thatthe program. The Board has additionally delegated assessment and monitoring of the Company's environmental, social and governance ("ESG") and DEI practices to the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee presently consists of Jan A. EddyLaurie S. Benson (Chair), Mark D. Bugher, John M. Silseth, Jerome J. SmithCarla C. Chavarria and Dean W. Voeks.Jan A. Eddy. The Board has determined that each of the Corporate Governance and Nominating Committee members is considered to be “independent” according to applicable NASDAQNasdaq rules and has further determined that each current member is qualified to serve in such capacity.

The Operational Risk Committee's primary function is to assess and manage certain of Directors

15

Board Role in Risk Oversight

| Oversight of Risk | ||

•The Board has an active and ongoing role in the management of the risks of the Company. It is responsible for general oversight of risk management; •The Operational Risk Committee was established in 2018 to evaluate and monitor the Company’s strategic risk and its key operational risks, including overseeing management's execution of the ERM Program and periodically evaluating the Board’s risk management structure and processes to ensure appropriate Board-level risk reporting; •Company management is responsible for assessing and managing risk through robust internal processes and effective internal controls and for providing appropriate reporting to the Board and its committees. | ||

The Company believes that establishing the right “tone at the top” and providing for full and open communication between management and the Board is essential for effective risk management and oversight. The Board, acting as a whole and through its committees, is responsible for oversight of the Company’s enterprise wide risk management including, but not limited to, strategic, risk, financial, reporting risk, credit, risk, liquidity, risk, compensation, risk, cyber riskinformation security, regulatory, reputational, and operational risk.risks. Given the critical link between strategy and risk, the Board is also responsible for developing strategies based on an assessment of the Company’s overall risk tolerance, the related opportunities and the capacity to manage the resulting risk. AtAs part of its annualongoing planning, session, the Board meetsdiscusses with executive management to discuss the strategies, key challenges, risks and opportunities facing the Company.

Under the ERM Program, a Risk Dashboard has been developed, the Company’s most significant risks along with related metrics/key risk indicators (“KRIs”) have been identified, and risk tolerance thresholds established. ERM is a standing agenda item for each of the Board’s regular quarterly meetings. At these meetings the Board reviews the Risk Dashboard, the status of each KRI relative to the designated tolerance threshold and the related remediation plans. The Board additionally delegateshas delegated oversight of each of these specificthe key risks to either the Audit, Compensation, or Corporate Governance and Nominating or Operational Risk Committee in accordance with the committee charters. These charters which are reviewed annually to reflect the changing risk environment. Each committee monitors the assigned specific key risks, ensures that appropriate risk mitigation strategiesplans are in place, identifies emerging risks, reports back to the Board with recommendations and updates and apprises the Board of any areas of concern. The following table summarizes each committee’s role in the risk oversight function:

| Committee | Risk Oversight Focus | ||||

| Audit Committee | •Monitors the integrity of the financial statements, effectiveness of internal control over financial reporting, compliance with applicable legal and regulatory requirements, and the performance of the Company’s internal independent auditors. | ||||

| Compensation Committee | •Oversees the Company’s executive compensation program, evaluates risks presented by all compensation programs and confirms that the programs do not encourage risk-taking to a degree that is likely to have a materially adverse impact on the Company, do not encourage the management team to take unnecessary and excessive risks that threaten the value of the Company and do not encourage the manipulation of reported earnings of the Company. | ||||

| Corporate Governance and Nominating Committee | •Monitors key risks including risks relating to corporate governance structure, director independence, and succession. •Assesses and monitors the Company's ESG and director DEI practices. | ||||

| Operational Risk Committee | •Assures the ERM Program is operating effectively. •Monitors the strategic risk based on an assessment of the Company’s strategies in the context of the Company’s overall risk tolerance, related opportunities and capacity to manage the resulting risk. •Evaluates, monitors and advises the Board on all matters relating to maintaining the right tone at the top. •Evaluates, monitors and assesses key risks via quarterly updates from senior management related to credit risk; information security/cyber risk; regulatory, compliance and legal risk; operational risk and liquidity and market risk. | ||||

Management is responsible for the day to dayday-to-day management of the Company’s key risks and operates through a Senior Management Risk Committee (“SMRC”) which monitors key risks, develops and executes mitigation or remediation plans as appropriate, identifies emerging risks, evaluates the effectiveness of the Company’s risk management processes and reports such to the Board or its committees on a regular basis.

CEO and Evaluation ProcessExecutive Officer Succession Planning

management. Because of the significance of the CEO’s leadership, the full Board retains primary responsibility for oversight of CEO succession planning.planning as well as overall executive leadership development and succession planning practices and strategies. The Board has delegated certain responsibility for the ongoing development and monitoring of CEO and executive officer succession planning to the Corporate Governance and Nominating Committee, and at least annually, that committee reviews the policies and principles of selecting a successor to the CEO, both in an emergency situation as well asCEO. The Board participates in the ordinary courseannual review of business. This reviewthe CEO succession plan, which includes an assessment of potential internal and external successors andCEO candidates, contingency plans in the event of a sudden termination (including death or disability) as well as a review, development plans that are being utilized to strengthen the skills and qualifications of candidates and the Company CEO’s recommendations for contingency and longer term succession planning for the CEO position. Annually, theand executive officer positions. The Corporate Governance and Nominating Committee in accordance with its charter also reviews succession plans for the status of the CEO succession plan with the full Board.other executive officers.

PRINCIPAL SHAREHOLDERS

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of March 16, 2016February 26, 2021 by: (i) each director and director nominee; (ii) each of the executive officers named in the Summary Compensation Table on page 37 (the “Named Executive Officers”); (iii) all of the directors, director nominees and executive officers (including the Named Executive Officers) as a group; and (iv) persons known to the Company to be the beneficial owner of more than five percent of the Company’s Common Stock. Except as otherwise indicated in the footnotes, each of the holders listed below has sole voting and investment power over the shares beneficially owned by such holder. AsThe percentage of March 16, 2016, there were 8,700,172beneficial ownership shown in the following table is based on 8,640,143 shares of Common Stock outstanding.outstanding as of February 26, 2021. For purposes of calculating each person’s or group’s percentage ownership, shares of Common Stock issuable pursuant to the terms of restricted stock awards vesting within 60 days after February 26, 2021 are included as outstanding and beneficially owned for that person or group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person or group.

| Name of Beneficial Owner | Shares of Common Stock Beneficially Owned | Percent of Common Stock Beneficially Owned | ||||||

Laurie S. Benson(1) | 4,316 | * | ||||||

Mark D. Bugher(2) | 9,923 | * | ||||||

Corey A. Chambas(3) | 143,036 | 1.7% | ||||||

Carla C. Chavarria(4) | 1,513 | * | ||||||

Jan A. Eddy(5) | 17,446 | * | ||||||

John J. Harris(6) | 10,390 | * | ||||||

Ralph R. Kauten(7) | 29,288 | * | ||||||

Timothy J. Keane(8) | 8,285 | * | ||||||

Gerald L. Kilcoyne(9) | 51,826 | * | ||||||

W. Kent Lorenz(10) | 17,559 | * | ||||||

Mark J. Meloy(11) | 49,939 | * | ||||||

Daniel P. Olszewski(12) | 21,970 | * | ||||||

Brad A. Quade(13) | 7,263 | * | ||||||

Carol P. Sanders(14) | 6,489 | * | ||||||

David R. Seiler(15) | 16,026 | * | ||||||

Edward G. Sloane, Jr(16) | 14,937 | * | ||||||

All directors, nominees and executive officers as a group (19 persons)(17) | 465,684 | 5.4% | ||||||

| 5% Holders | ||||||||

The Banc Funds Company, LLC(18) | 772,628 | 9.1% | ||||||

BlackRock, Inc.(19) | 478,350 | 5.6% | ||||||

Dimensional Fund Advisors LP(20) | 438,980 | 5.2% | ||||||

| *Denotes less than 1% | ||||||||

18

| Name of Beneficial Owner | Shares of Common Stock Beneficially Owned | Percent of Common Stock Beneficially Owned | |||||

| Corey A. Chambas....................................................... | 172,563 | 2.0% | |||||

| John M. Silseth............................................................ | 70,000 | * | |||||

| James F. Ropella (1).................................................... | 62,924 | (2) | * | ||||

| Jerome J. Smith........................................................... | 51,937 | (3) | * | ||||

| Charles H. Batson…………………………………… | 44,980 | * | |||||

| Michael J. Losenegger................................................. | 41,450 | (4) | * | ||||

| Gerald L. Kilcoyne...................................................... | 29,136 | (5) | * | ||||

| Pamela R. Berneking................................................... | 21,694 | * | |||||

| Jan A. Eddy.................................................................. | 16,056 | (6) | * | ||||

| Dean W. Voeks............................................................. | 11,192 | * | |||||

| Barbara H. Stephens.................................................... | 9,000 | (7) | * | ||||

| Mark D. Bugher........................................................... | 8,680 | (8) | * | ||||

| John J. Harris............................................................... | 6,000 | (9) | * | ||||

| David R. Papritz (10)……………………………….. | |||||||

All directors, nominees and executive officers as a group (20 persons)................................... | 725,731 | (11) | 8.3% | ||||

| 5% Holders | |||||||

| The Banc Funds Company, L.L.C (12)………........... | 660,728 | 7.6% | |||||

| Wellington Management Group LLP (13)………….. | 478,550 | 5.5% | |||||

| (1) | Includes 390 restricted shares over which Ms. Benson has voting power but does not have investment power, and | ||||

| 3,926 shares held through a sole IRA. | |||||

| (2) | Includes | ||||

| (3) | Includes 13,134 restricted shares over which Mr. Chambas has voting power but does not have investment power, and 16,992 shares held through a 401(k) Plan. | ||||

| (4) | Includes 390 restricted shares over which Ms. Chavarria has voting power but does not have investment power, and 1,123 shares held via a sole trust. | ||||

| Includes | |||||

| (6) | Includes 390 restricted shares over which Mr. Harris has voting power but does not have investment power, and 10,000 shares held jointly with his spouse. | ||||

| (7) | Includes 390 restricted shares over which Mr. Kauten has voting power but does not have investment power, 3,300 shares held by a sole IRA, and 12,687 shares held by a family-owned LLC. | ||||

| (8) | Includes 390 restricted shares over which Mr. Keane has voting power but does not have investment power, and 2,637 shares held in a joint trust with his spouse. | ||||

| (9) | Includes 390 restricted shares over which Mr. Kilcoyne has voting power but does not have investment power, 6,800 shares held by a sole IRA, and 44,636 shares held in a joint trust with his spouse. | ||||

| (10) | Includes 390 restricted shares over which Mr. | ||||

| Lorenz has voting power but does not have investment power, and 2,520 shares held by a sole IRA, 6,471 shares held in a joint trust with his spouse, and 8,178 shares held solely by his spouse through an IRA. | |||||

| (11) | Includes | ||||

| (12) | Includes 390 restricted shares over which Mr. Olszewski has voting power but does not have investment power, and 21,580 shares held in a joint trust with his spouse. | ||||

| (13) | Includes 5,799 restricted shares over which Mr. Quade has voting power but does not have investment power. | ||||

| (14) | Includes 390 restricted shares over which Ms. Sanders has voting power but does not have investment power, and 670 shares held in a joint trust with her spouse and 5,429 shares held by a SEP IRA. | ||||

| (15) | Includes 4,900 restricted shares over which Mr. Seiler has voting power but does not have investment power, and 4,000 shares held in a joint trust with his spouse. | ||||

| (16) | Includes 4,617 restricted shares over which Mr. Sloane has voting power but does not have investment power, and 4,122 shares held jointly with his spouse. | ||||

| (17) | Includes 44,384 restricted shares over which the individuals have voting power but do not have investment power, 10,678 shares held by spouses of the group members, | ||||

| members. | |||||

| (18) | |||||

| Information based on Schedule 13G/A filed with the SEC on February | |||||

| Information based on Schedule 13G, filed with the SEC on January 29, 2021 by BlackRock, Inc. According to the Schedule 13G, Blackrock, Inc. had sole voting power with respect to 468,735 shares, and sole dispositive power with respect to 478,350 shares. According to the Schedule 13G, their principal business office is 55 East 52nd Street New York, NY 10055. | |||||

| (20) | Information based on Schedule 13G, filed with the SEC on February | ||||

19

DIRECTOR COMPENSATION

In 2015,2020, each non-employee director of the Company, who was not an executive officer of the Company received an annual retainer of $24,000. TheAs the Company’s Board Chair, Mr. Kilcoyne received an additional annual retainer comprisedcash compensation of $50,000 in cash and $59,900 in Company stock.$60,250. The Chair of the Compensation Committee and the Chair, of the Corporate Governance and Nominating Committee Chair, and the Operational Risk Committee Chair received additional annual retainers of $5,000, while the Chair of the Audit Committee Chair received an additional annual retainer of $10,000. All Board and committee members, except those serving as executive officers of the Company, were paid $750 for each Board and committee meeting attended in person or via teleconference. Allattended. Except for the annual restricted stock awards described below, director retainer and committeemeeting attendance fees were paid in cash except forquarterly.

In 2019, the stock issuedCompensation Committee engaged McLagan, its outside independent compensation consultant, to Smith.

Fees earned or paid in cash (1) | Stock awards (2) | All other compensation (3) | Total | |

| Mark D. Bugher | $35,250 | — | — | $35,250 |

| Jan A. Eddy | $40,250 | — | — | $40,250 |

| John J. Harris | $38,250 | — | — | $38,250 |

| Gerald L. Kilcoyne | $67,950 | — | — | $67,950 |

| John M. Silseth | $57,800 | — | — | $57,800 |

| Jerome J. Smith | $81,500 | $59,900 | $47,373 | $188,773 |

| Barbara H. Stephens | $39,500 | — | — | $39,500 |

| Dean W. Voeks | $49,000 | — | — | $49,000 |

Fees earned or paid in cash (1) | Stock awards(2) | Total | |||||||||

| Laurie S. Benson | $40,100 | $6,306 | $46,406 | ||||||||

| Mark D. Bugher | $39,500 | $6,306 | $45,806 | ||||||||

| Carla C. Chavarria | $31,500 | $6,306 | $37,806 | ||||||||

| Jan A. Eddy | $39,500 | $6,306 | $45,806 | ||||||||

| John J. Harris | $34,500 | $6,306 | $40,806 | ||||||||

| Ralph R. Kauten | $33,750 | $6,306 | $40,056 | ||||||||

| Timothy J. Keane | $38,250 | $6,306 | $44,556 | ||||||||

| Gerald L. Kilcoyne | $96,750 | $6,306 | $103,056 | ||||||||

| W. Kent Lorenz | $40,850 | $6,306 | $47,156 | ||||||||

| Daniel P. Olszewski | $31,500 | $6,306 | $37,806 | ||||||||

| Carol P. Sanders | $41,500 | $6,306 | $47,806 | ||||||||

| (1) | Includes FBFS Board retainer and FBFS and FBB Board and committee meeting attendance fees paid in cash. | ||||

| (2) | On May 18, 2020 each non-employee director received a restricted stock award. The number of shares granted was equal to $10,000 based on the share value used in granting executive officer and employee restricted stock in February 2020. Each director received 390 shares and the stock award amounts are the grant date value based on $16.17 which was the closing share price on May 18, 2020. | ||||

20

THE COMPANY'S APPROACH TO SOCIAL RESPONSIBILITY AND HUMAN CAPITAL MANAGEMENT

The COVID-19 Pandemic

Although 2020 presented unprecedented challenges as a result of the COVID-19 pandemic, the Company's employees dedicated themselves to supporting each other and our clients in exceptional ways to deliver for our clients, our communities and our shareholders.

How the Company supported employees during the COVID-19 pandemic

•Implemented the COVID-19 pandemic preparedness plan previously developed as part of the Company's business continuity plan. Prior to the COVID-19 pandemic, 16% of the Company's workforce was working remotely. By March 16, 2020, 95% of the Company's workforce was working remotely.

•Suspended restrictions in remote work policy to allow employees flexibility to care for their children and family members during work hours.

•Required strict adherence to all Department of Health, state and local health and safety protocols and personal protective equipment guidelines while working onsite.

•Developed an automated tracking system to monitor onsite capacity limits to facilitate employees' ability to return to office as necessary to perform their job functions and/or for their overall well-being.

•Hosted virtual wellness sessions supporting employees’ and their families’ well-being.

•Expanded the Employee Assistance Program offering and provided national access and resources via the web, mobile apps and texting.

•No furloughs or layoffs were made related to the COVID-19 pandemic.

How the employees responded on behalf of the Company during the COVID-19 pandemic

•Essential frontline employees kept the Bank lobbies open to provide uninterrupted service to our clients.

•Modified existing proprietary technology which was leveraged to efficiently process Paycheck Protection Program ("PPP") loans.

•Interviewed, onboarded, and welcomed new employees completely virtually.

•Launched a new floorplan financing business line.

•Held a virtual annual shareholder meeting which enabled all shareholders to participate regardless of geographic location.

•Maintained strong performance in spite of challenging circumstances, as evidenced by record loan growth, expansion of assets under management by the Bank's Private Wealth team to over $2 billion, and refreshing and aligning the Company's branding and logo.

How the Company culture was strengthened during the COVID-19 pandemic

•Held frequent live CEO question and answer ("Q&A") forums via videoconference with regular participation of 85% or more employees.

•Achieved the highest ever level of employee engagement with a score of 91% and an 87% survey participation rate.

•Employees collaborated and connected with each other in new and innovative ways as a result of the remote work environment.

•Achieved an employee retention rate of over 90%.

21

Social Responsibility

The Company is committed to the communities we serve, our employees and shareholders. The Company believes that visionary, determined entrepreneurs and investors create a thriving economy and when these businesses succeed, they create social and economic advancement for their employees, investors, families and communities at large. This commitment is reflected in activities completed in conjunction with local businesses, the public sector and not-for-profit organizations. This commitment and investment in the communities we serve is a foundation to the Company’s long-term success for the benefit of our shareholders.

•Processed more than 700 PPP loan applications which provided funding for small- and medium-sized businesses employing more than 26,000 people in the markets we serve.

•Invested in our communities via Community Reinvestment Act lending activities and sound loan administration to promote sustainable growth.

•Announced a $1 million commitment to the Dane Workforce Housing Fund, which is addressing the lack of affordable housing in the local community.

•Facilitated approximately $500,000 in sponsorship and contributions in 2020, including a $25,000 donation to the United Way specifically designated for COVID-19 relief efforts.

•Awarded "Outstanding Business" on the 2020 National Philanthropy Day by the Association for Financial Professionals - Greater Madison.

•Offered employees a full day off with pay to support volunteer efforts of their choosing. In 2020, 125 employees spent more than 7,700 hours volunteering which impacted nearly 215 not-for-profit organizations.

•Launched an Employee Stock Purchase Program to provide our employees with an opportunity to purchase Common Stock, providing a personal stake in the continued success of the Company.

Human Capital Management

The consulting arrangement between Mr. SmithCompany believes that achieving strong financial results begins with our employees. In 2020, the workforce grew to over 300 employees. While the majority of employees are located in our primary banking markets, we now have employees in over 20 states. This expansion has allowed the Company to diversify the workforce and add business development officers and specialists to support business line growth.

The Company's employees embody ambition, experience and client focus. The work environment fosters innovation, continuous improvement and embracing change. In 2020, the employees delivered an unmatched client experience and the Company was terminatedachieved a 96% client satisfaction rating.